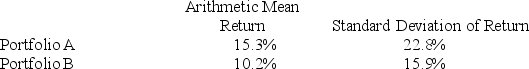

The table below gives statistics relating to a hypothetical 10-year record of two portfolios. Assume other statistics relating to these portfolios are the same and the risk-free rate is 3.5%.  Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Using the coefficient of variation and the Sharpe ratio, the fund that is preferred in terms of relative risk and return per unit of risk is ________.

Definitions:

Descriptive Research Methods

Research techniques that describe the characteristics of a population or phenomenon being studied, without attempting to determine cause and effect relationships.

Surveys

Research methods involving the collection of data from a predefined group of respondents to gather information and insights on various topics of interest.

Interviews

A method of gathering information by asking questions face-to-face, over the phone, or via digital platforms.

Stimulate

To encourage or provoke an activity or increase in functionality either physically or mentally.

Q15: Suppose the round-trip airfare between Boston and

Q58: A respondent to a survey indicates that

Q78: What is a characteristic of the mass

Q102: Exams are approaching and Helen is allocating

Q104: A construction company found that on average

Q104: Tom's gross pay for this month is

Q115: An auto parts chain asked customers to

Q122: If an exponential distribution has the rate

Q123: The following data are a list of

Q142: Where does Unearned subscription revenue appear on