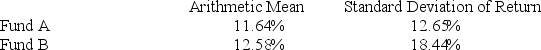

The following table summarizes selected statistics for two portfolios for a 10-year period. Assume that the risk-free rate is 4% over this period.  As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

As measured by the Sharpe ratio, the fund with the superior risk-adjusted performance during this period is ________.

Definitions:

House of Burgesses

The first legislative assembly of elected representatives in North America, established in the Colony of Virginia in 1619.

Representative Government

A form of government in which citizens elect officials to create laws and policies on their behalf.

Joint Stock Companies

Businesses owned by shareholders where the stock can be bought and sold on the open market, spreading the risk and profit among many.

English Investors

Individuals or entities from England that allocate capital with the expectation of earning a financial return, often involving investments in foreign or domestic markets.

Q12: The addition rule is used to determine

Q35: A consumer who is risk neutral is

Q52: The variance of a random variable X

Q57: For a particular clothing store, a marketing

Q61: Suppose the wait to pass through immigration

Q65: Suppose the life of a particular brand

Q76: A risk-loving consumer will take on risk

Q108: A college professor collected data on the

Q116: Alex is in a hurry to get

Q129: Permutations are used when the order in