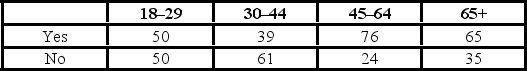

Restaurants in London, Paris, and New York want diners to experience eating in pitch darkness to heighten their senses of taste and smell (Vanity Fair, December 2011). Suppose 400 people were asked, "If given the opportunity, would you eat at one of these restaurants?" The accompanying contingency table, cross-classified by age, would be produced.  a. What is the probability that a respondent would eat at one of these restaurants?

a. What is the probability that a respondent would eat at one of these restaurants?

B) What is the probability that a respondent would eat at one of these restaurants or is in the 30-44 age bracket?

C) Given that the respondent would eat at one of these restaurants, what is the probability that he or she is in the 30-44 age bracket?

D) Is whether a respondent would eat at one of these restaurants independent of one's age? Explain using probabilities.

Definitions:

Excise Tax

A type of indirect tax imposed on specific goods, such as tobacco and alcohol, often with the aim of reducing their consumption or generating revenue.

Public Golf Courses

Golf facilities that are owned by a government entity and are open to the public, typically requiring payment of a fee for use.

Regressive Tax

A tax system where the tax rate decreases as the taxable amount increases, leading to a higher burden on lower-income individuals.

High-Income

A category used to describe individuals or households that earn significantly more money than the average for their area or country.

Q24: The t<sub>df </sub>distribution consists of a family

Q28: Which of the following is considered an

Q31: A daily mail is delivered to your

Q37: When a characteristic of interest differs among

Q59: The formula for a z-score is =

Q64: Janice Anooshian asks eight of her friends

Q68: What are the primary reasons that sampling

Q91: When some objects are randomly selected, which

Q132: The time for a professor to grade

Q139: Suppose a baseball team has 14 players