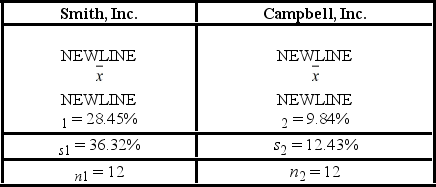

A researcher compares the returns for two mutual funds, Smith, Inc. and Campbell, Inc. to determine which of the two has a higher risk rate. She assumes that the returns are normally distributed. Implement the critical value approach at a significance level of 10%. The sample descriptive measures are given below.

Definitions:

Operating Leverage

A measure of how revenue growth translates into growth in operating income, indicating the proportion of fixed costs in a company's cost structure.

Operating Income

The profit realized from a business's core operations, calculated before interest and taxes are deducted.

Break-even Point

The level of production or sales at which total costs equal total revenue, meaning no net loss or gain is incurred; a crucial financial analysis metric.

Break-even Point

The break-even point is the level of production or sales at which total revenues equal total expenses, resulting in no net profit or loss.

Q2: The formula for the confidence interval of

Q4: In August 2010, Massachusetts enacted a 150-day

Q19: A professional baseball player changed his throwing

Q61: Which of the following R functions is

Q74: When some explanatory variables of a regression

Q97: The hypothesis statement H: μ < 60

Q99: A university is interested in promoting graduates

Q99: The hypothesis test H<sub>0</sub>: p<sub>1</sub> - p<sub>2</sub>

Q104: Consider the following regression results based on

Q127: The mortgage foreclosure crisis that preceded the