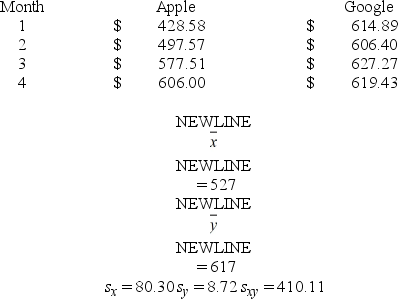

A portfolio manager is interested in reducing the risk of a particular portfolio by including assets that have little, if any, correlation. He wonders whether the stock prices for the firms Apple and Google are correlated. As a very preliminary step, he collects the monthly closing stock price for each firm from January 2012 to April 2012.  a. Compute the sample correlation coefficient.

a. Compute the sample correlation coefficient.

B) Specify the competing hypotheses to determine whether the stock prices are correlated.

C) Calculate the value of the test statistic and approximate the corresponding p-value.

D) At the 5% significance level, what is the conclusion to the test? Explain.

Definitions:

Reinforcement

A process in learning theory where behaviors are encouraged or discouraged through rewards or punishments.

Academic Pursuit

The active engagement in educational activities with the aim of gaining knowledge, skills, and qualifications.

Behaviorism

A theory of learning based on the idea that all behaviors are acquired through conditioning by interacting with the environment.

Operant Conditioning

A method of learning that employs rewards and punishments for behavior, encouraging the subject to associate certain actions with specific consequences.

Q9: _ patterns are caused by the presence

Q13: A realtor wants to predict and compare

Q25: For the logit model, the predicted values

Q27: The _ is a trend model that

Q71: The following ratio-to-moving averages for the seasonally

Q81: A researcher with the Ministry of Transportation

Q85: The correlation coefficient can only range between

Q94: If there are T observations to estimate

Q107: To examine the differences between salaries of

Q114: The log-log and exponential models, ln(x) =