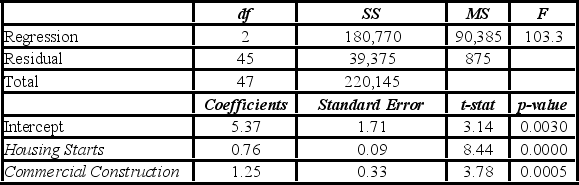

Assume you ran a multiple regression to gain a better understanding of the relationship between lumber sales, housing starts, and commercial construction. The regression uses lumber sales (in $100,000s) as the response variable with housing starts (in 1,000s) and commercial construction (in 1,000s) as the explanatory variables. The estimated model is Lumber Sales = β0 + β1Housing Starts + β2Commercial Constructions + ε. The following ANOVA table summarizes a portion of the regression results.  If Housing Starts were 17,000 and Commercial Construction was 3,200, the best estimate of Lumber Sales would be ________.

If Housing Starts were 17,000 and Commercial Construction was 3,200, the best estimate of Lumber Sales would be ________.

Definitions:

Messages To Other Cells

The process by which cells communicate with each other through the release and reception of chemical signals or neurotransmitters.

Receive Messages

The process of perceiving and interpreting information from others through various forms of communication.

Send Messages

The act of transmitting information from one individual or entity to another through various forms of communication.

Dendrites

Branch-like extensions of a neuron that receive signals from other neurons and transmit these signals towards the cell body.

Q2: Using a _ we can determine if

Q8: To examine the differences between salaries of

Q36: A student has to decide whether he

Q46: A researcher wants to examine how the

Q61: In a model y = β<sub>0</sub> +

Q62: For the goodness-of-fit test for normality to

Q73: The ANOVA test performed for determined that

Q74: Suppose you want to determine if gender

Q80: Assume you ran a multiple regression to

Q103: The following data for five years of