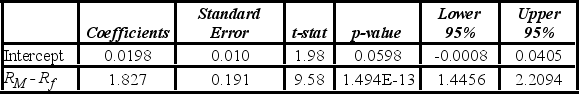

Tiffany & Co. has been the world's premier jeweler since 1837. The performance of Tiffany's stock is likely to be strongly influenced by the economy. Monthly data for Tiffany's risk-adjusted return and the risk-adjusted market return are collected for a five-year period  . The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Tiffany's return.

. The accompanying table shows the regression results when estimating the Capital Asset Pricing Model (CAPM) model for Tiffany's return.  When testing whether the beta coefficient is significantly greater than one, the relevant critical value at the 5% significance level is t0.05,58 = 1.672. The conclusion to the test is to ________.

When testing whether the beta coefficient is significantly greater than one, the relevant critical value at the 5% significance level is t0.05,58 = 1.672. The conclusion to the test is to ________.

Definitions:

Asian Children

Children of Asian descent, potentially focusing on their cultural, social, or developmental aspects within various contexts.

Discouraged Worker

An individual who is not actively seeking employment due to a belief that no suitable job opportunities exist or they would not find employment.

Retiree

A person who has withdrawn from their profession or occupation and is no longer engaged in paid work.

Age Discrimination

Prejudice or discrimination against individuals or groups based on their age, typically against older adults in employment and other areas.

Q4: Based on quarterly data collected over the

Q8: The fit of the regression equations <img

Q35: Typically, the sales volume declines with an

Q48: A researcher wants to understand how an

Q56: A manager at a local bank analyzed

Q58: Given the following portion of regression results,

Q60: The price of a basket of goods

Q76: Psychology students want to determine if there

Q93: A researcher wants to verify his belief

Q115: A market researcher is studying the spending