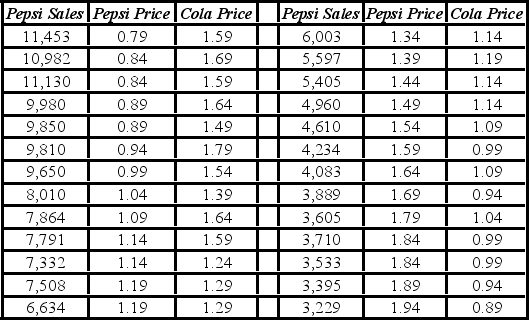

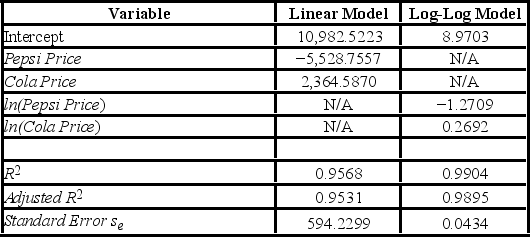

It is believed that the sales volume of one-liter Pepsi bottles depends on the price of the bottle and the price of a one-liter bottle of Coca-Cola. The following data have been collected for a certain sales region.  The linear model Pepsi Sales = β0 + β1Pepsi Price + β2Cola Price + ε and the log-log model ln(Pepsi Sales) = β0 + β1ln(Pepsi Price) + β2ln(Cola Price) + ε have been estimated as follows:

The linear model Pepsi Sales = β0 + β1Pepsi Price + β2Cola Price + ε and the log-log model ln(Pepsi Sales) = β0 + β1ln(Pepsi Price) + β2ln(Cola Price) + ε have been estimated as follows:  For log-log model, interpret the estimated coefficient for ln(Cola Price).

For log-log model, interpret the estimated coefficient for ln(Cola Price).

Definitions:

Rising Rate

An increasing trend in interest or inflation rates over a certain period.

Maturity Value

The amount to be paid to the holder of a financial instrument at the end of its term, including the principal and any accumulated interest or dividends.

Compounded Semi-annually

A method of calculating interest where the interest is added to the principal twice a year.

Strip Bond

A type of bond investment where the coupon payments and the principal are separated and sold individually as zero-coupon instruments.

Q1: Which of the following is a causal

Q4: Given the augmented Phillips model: y =

Q10: A binary choice model is also referred

Q38: The one-way ANOVA null hypothesis is rejected

Q45: The actual value y may differ from

Q66: Three firms, X, Y, and Z, operate

Q78: When testing whether the correlation coefficient differs

Q96: The following scatterplot shows productivity and number

Q97: Tammy Welsh has two investment options to

Q116: Parametric tests are distribution-free tests.