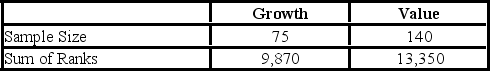

A fund manager wants to know if the annual rate of return is greater for growth stocks (sample 1) than for value stocks (sample 2) . The fund manager collects data on the returns of growth and value funds. Below are the sample sizes and rank sums for the Wilcoxon rank-sum test.  At the 1% significance level, the critical value is ________.

At the 1% significance level, the critical value is ________.

Definitions:

Momentum

In finance, refers to the tendency of an investment to continue moving in its current direction, either up or down, based on recent performance.

Reversal Patterns

Technical analysis term referring to signals indicating a potential change in a security's price direction.

Semistrong Form

A form of market efficiency that implies that all publicly available information is already reflected in stock prices, including historical data and public news.

Current Stock Price

This refers to the present value at which a stock is traded on the market.

Q5: Which of the following is true about

Q29: What type of swap arrangement is commonly

Q31: Which of the following equations is a

Q34: A bank manager is interested in assigning

Q34: The following data show the cooling temperatures

Q52: In what type of swap contract is

Q67: When a time series has both trend

Q77: To extract the trend from a time

Q93: Hugh Wallace has the following information regarding

Q94: A realtor wants to predict and compare