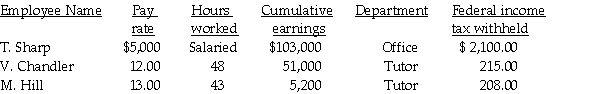

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total employer's payroll tax.

Definitions:

George Washington

The first President of the United States (1789-1797), commander-in-chief of the Continental Army during the American Revolutionary War, and one of the Founding Fathers of the United States.

Fort Necessity

A historic site in Pennsylvania, USA, where a battle early in the French and Indian War took place, involving a young George Washington.

Edward Braddock

A British general who led a failed expedition during the early stages of the French and Indian War.

French Canadians

People of French descent who live in Canada, particularly in the province of Quebec, known for maintaining a distinct French culture, language, and identity.

Q6: Use the answer you found when adding

Q18: A calendar quarter is made up of:<br>A)4

Q21: A deposit ticket usually separates checks deposited

Q37: Determine the cash short (-)or over (+)given

Q47: S.Ferrari,an employee of Plum Hollow Country Club,earned

Q56: Compute the total employers payroll tax._

Q99: Calculate,from the following information accumulated by

Q106: The post-closing trial balance is used to

Q109: The amount of FICA-OASDI and FICA-Medicare withheld

Q111: Insurance paid in advance by employers to