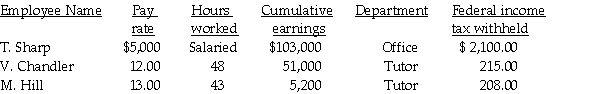

Ben's Mentoring had the following information for the pay period ending September 30:  Assume:

Assume:

FICA-OASDI applied to the first $128,400 at a rate of 6.2%.

FICA-Medicare applied at a rate of 1.45%.

FUTA applied to the first $7,000 at a rate of 0.8%.

SUTA applied to the first $7,000 at a rate of 5.6%.

State income tax is 3.8%.

Employees contribute to their retirement fund at a rate of 5.5% of their gross earnings.

-Compute the total deductions.

Definitions:

Sales Territories

Defined geographic areas or customer groups for which individual sales representatives or sales teams are responsible.

Geographic Location

The specific physical location of a place on the Earth's surface.

Functional Groupings

The organization of objects, individuals, or data based on their characteristics or roles to achieve efficiency or categorization.

Business Activities

Operations, tasks, and work performed by a company to generate profits, including production, sales, and distribution among others.

Q2: Consider an Edgeworth economy where there are

Q7: A _ is a person who wants

Q50: The two parts of FICA are OASDI

Q53: As the Prepaid Workers Compensation is recognized,the

Q54: <span class="ql-formula" data-value="\begin{array} { | l |

Q61: Which of the following bank reconciliation items

Q68: Prepare the necessary general journal entry for

Q70: Prepare the required journal entries from the

Q73: On November 1,Duane paid $24,000 in advance

Q104: <span class="ql-formula" data-value="\begin{array} { | l |