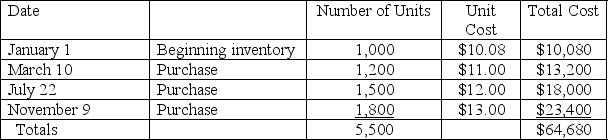

Umatilla Tile Company compiled the following inventory information for the current year.Sales for the year were 3,500 units at $25 each.Total operating expenses for the year,excluding cost of goods sold,were $35,000.The company maintains a periodic inventory system.

Required:

Required:

1.Determine the ending inventory cost assuming the company uses the weighted average inventory method.

2.Determine the net income that will be reported on the income statement assuming the company uses the weighted average inventory method.

Definitions:

Qualified Education Expenses

Expenditures for tuition and related educational costs that are necessary for enrollment at an eligible educational institution.

Student Loan Interest

The interest paid on a loan taken out to fund educational expenses, potentially deductible under certain conditions from your taxable income.

Modified AGI

An adjusted gross income figure used for specific tax calculations, modified by adding back certain deductions and exclusions.

Self-employment Tax

The tax self-employed individuals must pay to cover their Social Security and Medicare obligations.

Q10: The employees of Dew Drop Inn get

Q60: Newcastle Company has the following inventory data

Q78: Identify the appropriate accounting treatment for each

Q105: On January 1,2011,Albatross Shipping Company bought equipment

Q156: What effect does depreciating a long-term asset

Q157: A client has asked you to review

Q161: An accelerated depreciation method refers to any

Q169: On January 1,2011,We Haul,Inc.bought a $48,000 truck,which

Q239: Accrual accounting requires that revenue be recorded

Q277: On October 31,2011,Bondable,Inc.issued $20,000 of 10-year,6% bonds