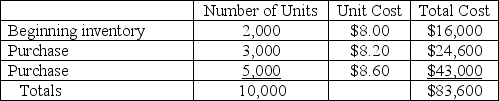

Fargo Engines Incorporated sells part number 45G to toy manufacturers around the world.Information about part number 45G is contained in the table below.Fargo uses a weighted-average periodic inventory system.  Determine the cost of goods sold and ending inventory cost of part 45G if 2,000 units remain unsold in inventory at the end of the accounting period.

Determine the cost of goods sold and ending inventory cost of part 45G if 2,000 units remain unsold in inventory at the end of the accounting period.

Definitions:

Absorption Costing

Absorption costing is an accounting method that includes all manufacturing costs (direct materials, direct labor, and both variable and fixed manufacturing overhead) in the cost of a product.

Absorption Costing

An accounting method that includes all manufacturing costs (both variable and fixed) in the cost of a product.

Unit Product Cost

The calculated cost associated with producing a single unit of product, including direct materials, labor, and overhead.

Absorption Costing

An accounting practice where the cost of a product is calculated by including all expenses from manufacturing, like direct materials, direct labor, and both variable and fixed overheads.

Q2: At December 31,2010,McToil,Inc.owes its employees $20,000 for

Q3: Y Company obtained the following balances from

Q13: Explain what gains and losses are,how they

Q64: Team Shirts' receivables turnover was 12 times

Q125: Credit card sales benefit companies because _.<br>A)the

Q155: The March bank statement for Jem's Jewelers

Q157: A client has asked you to review

Q200: Which statement below is Strength in controls

Q240: If the terms of purchase are FOB

Q249: Inventory information for Great Falls Merchandising,Inc.is provided