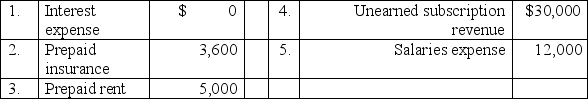

The following is a partial list of items from Chewy Candy,Inc.'s June 30,2011 financial statements.Its fiscal year runs from July 1 to June 30.

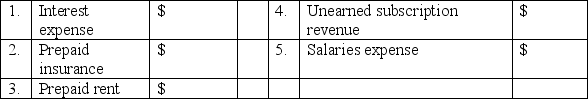

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation for the year ended June 30,2011.Show the correct dollar amounts,and write in the titles of the accounts affected.

Part A: In the worksheet below,record the effect of these five adjustments on the accounting equation for the year ended June 30,2011.Show the correct dollar amounts,and write in the titles of the accounts affected.

1.Adjusted the $3,600,3-year insurance policy that began on July 1,2010.

2.Accrued interest on its $100,000,12% note issued on July 1,2010.Interest and principal are due January 1,2012.

3.Earned $10,000 of the subscription revenue that had been collected in advance.

4.Adjusted the ten months of rent that was paid in advance on March 1,2011.

5.Owed salaries of $2,000 at yearend.Payday is on July 3,2011.

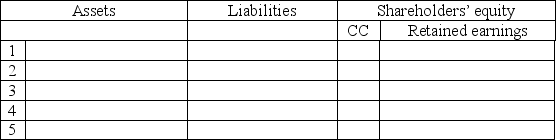

Part B: Fill in the adjusted balances as of June 30,2011.Some of the accounts that have been adjusted are not included in this table.

Part B: Fill in the adjusted balances as of June 30,2011.Some of the accounts that have been adjusted are not included in this table.

Definitions:

Sedimentary Cycle

Biochemical cycle such as the phosphorus cycle, in which the atmosphere plays little role and rocks are the major reservoir.

Carbon Cycle

Biogeochemical cycle in which carbon is exchanged between oceans, soils, atmosphere, and living organisms.

Phosphorus Cycle

Movement of phosphorus among Earth’s rocks and waters, and into and out of food webs.

Nitrogen Cycle

Movement of nitrogen among the atmosphere, soil, and water, and into and out of food webs.

Q1: Which of the following is NOT a

Q27: State the most applicable accounting rule for

Q46: Team Instructions: Divide the class into teams

Q47: In 2011,Seven Seas sold $20,000 worth of

Q79: Identify the effects of each of the

Q83: Identify each of the following reconciling items

Q154: The write-off of a specific customer's account

Q171: Brooke's Bikes sold $11,235 worth of mountain

Q177: Poe,Inc.made $7,000 of cash sales to customers.The

Q212: Mariner,Inc.bought a lobster boat on November 1,2011