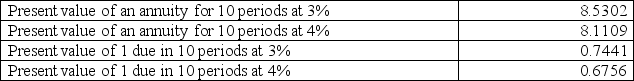

A company issues bonds with a par value of $800,000 on their issue date.The bonds mature in five years and pay 6% annual interest in two semiannual payments.On the issue date,the market rate of interest is 8%.Compute the price of the bonds on their issue date.The following information is taken from present value tables:

Definitions:

Price-fixing

An illegal agreement among competitors to set prices at a certain level, rather than competing naturally in the market.

Tying Contracts

Agreements where the sale of one product (the tying product) is conditioned on the buyer purchasing another product (the tied product).

Antitrust Laws

Legislation aimed at preventing anti-competitive practices, monopolies, and to promote fair competition for the benefit of consumers.

Monetary Award

A financial compensation granted to a party, often as a result of a legal settlement or judgement.

Q48: During the current year,Quark Company earned $90,000

Q62: Based on the following information provided about

Q70: Explain the preparation of journal entries to

Q75: Companies follow both the matching principle and

Q77: On January 1,2013,Merrill Company borrowed $100,000 on

Q109: A company had total assets of $745,000,total

Q136: A company purchased equipment on July 3

Q146: A company has bonds outstanding with a

Q156: Which of the following items is reported

Q193: _ allowances are items that reduce the