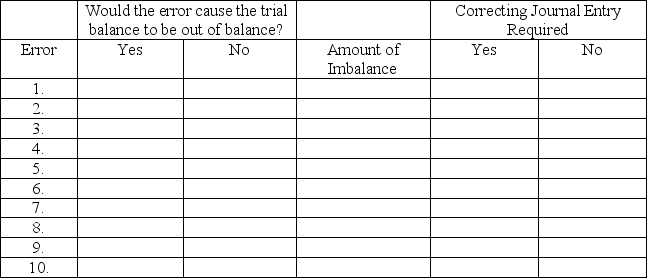

At year-end, Harris Cleaning Service noted the following errors in its trial balance:

1.It understated the total debits to the Cash account by $500 when computing the account

balance.

2.A credit sale for $311 was recorded as a credit to the revenue account,but the offsetting

debit was not posted.

3.A cash payment to a creditor for $2,600 was never recorded.

4.The $680 balance of the Prepaid Insurance account was listed in the credit column of the

trial balance.

5.A $24,900 truck purchase for cash was recorded as a $24,090 debit to Vehicles and a

$24,090 credit to Notes Payable.

6.A purchase of office supplies for $150 was recorded as a debit to Office Equipment.The

offsetting credit entry was correct.

7.An additional investment of $4,000 by Del Harris was recorded as a debit to Common

Stock and as a credit to Cash.

8.The cash payment of the $510 utility bill for December was recorded (but not paid) twice.

9.A revenue account balance of $79,817 was listed on the trial balance as $97,817.

10.A $1,000 cash dividend was recorded as a $100 debit to Dividends and $100 credit to cash.

Using the form below,indicate whether each error would cause the trial balance to be out of balance,the amount of any imbalance and whether a correcting journal entry is required.

Definitions:

Self-Control

The ability to regulate one's emotions, thoughts, and behaviors in the face of temptations and impulses.

Permissive

Refers to a lenient or liberal attitude, especially in the context of rules and disciplinary actions, favoring more freedom than restriction.

Authoritative Parents

A parenting style characterized by high demands and high responsiveness, where parents set clear standards but also respect their children’s autonomy.

Mexican American

An American citizen or resident of Mexican descent, often with a cultural heritage that includes traditions and customs from Mexico.

Q8: Eon Movers purchases supplies for $1,200 cash.How

Q17: Off-the-shelf accounting software is not adequate to

Q78: In a double-entry accounting system,the total amount

Q103: In the absence of a partnership agreement,the

Q132: The adjusted trial balance of Sara's Web

Q153: Under the _ system,each purchase,purchase return and

Q156: Effective accounting information systems will do all

Q177: Accrual accounting and the adjusting process rely

Q199: Roller Blade Company uses the perpetual inventory

Q222: On January 1,Able Company purchased equipment costing