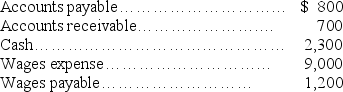

Use the following information as of December 31 to determine equity.

Definitions:

Progressive Tax

A tax system in which the tax rate increases as the taxable amount increases, placing a higher tax burden on wealthier individuals.

Proportional Tax

A tax system where the tax rate remains constant regardless of the amount subject to taxation, meaning that taxpayers pay the same percentage of their income in taxes regardless of how much they earn.

Regressive Tax

A tax that takes a larger percentage of income from low-income earners than from high-income earners, essentially burdening the poor more than the rich.

Proportional Tax

A proportional tax is a tax system where the tax rate remains constant regardless of the amount subject to taxation, meaning individuals pay the same percentage of their income regardless of income level.

Q5: The following accounts appear on either the

Q27: When using the equity method of accounting

Q40: How are partners' investments in a partnership

Q68: Baldwin and Tanner formed a partnership.Baldwin's initial

Q101: Describe the two alternate methods used to

Q108: Assume that a company uses a sales

Q111: Marquis and Bose agree to accept Sherman

Q160: Prepare a December 31 balance sheet in

Q183: The major activities of a business include:<br>A)Operating,investing,making

Q218: An account balance is the difference between