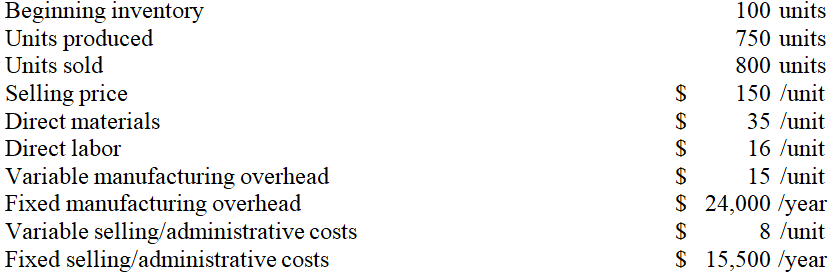

Hayes Inc.provided the following information for the current year:

-What is the unit product cost for the year using absorption costing?

Definitions:

Call Option

A financial contract giving the buyer the right, but not the obligation, to buy a stock, bond, commodity, or other assets at a specified price within a specific time period.

Volatility

The degree of variation of a trading price series over time, often used to gauge the risk in investments.

Put-call Parity

A principle in options pricing that shows the relationship between European put and call options with the same strike price and expiration date.

Risk-free Rate

The risk-free rate is the theoretical return of an investment with zero risk, representing the interest an investor would expect from an absolutely risk-free investment over a specified period.

Q7: Overhead costs:<br>A)Are directly related to production.<br>B)Can be

Q9: Variable budget is another name for:<br>A)Cash budget.<br>B)Flexible

Q22: Based on this information,the direct labor rate

Q48: Heather,Incorporated reports the following annual cost data

Q57: Claymore Corp.has the following information about its

Q118: The usefulness of overhead allocations based on

Q160: Compute the direct materials price variance. <br>A)$2,430

Q161: A cost pool is a collection of

Q186: Using absorption costing,which of the following manufacturing

Q241: A graphic depiction of the break-even point