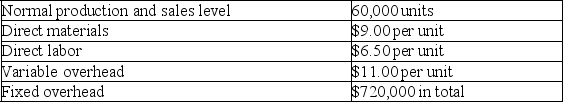

Heather,Incorporated reports the following annual cost data for its single product:

This product is normally sold for $56 per unit.If Heather increases its production to 80,000 units while sales remain at the current 60,000 unit level,by how much would the company's gross margin increase or decrease under absorption costing? Assume the company has idle capacity to increase current production.

This product is normally sold for $56 per unit.If Heather increases its production to 80,000 units while sales remain at the current 60,000 unit level,by how much would the company's gross margin increase or decrease under absorption costing? Assume the company has idle capacity to increase current production.

Definitions:

Bond Sinking Fund

A reserved fund established by a corporation or government entity to set aside money over time for the purpose of repaying bonds.

Recorded Interest

The interest that has been accrued or paid on borrowed funds or investments, documented in the financial records.

Callable Bonds

Bonds that can be redeemed by the issuer before their maturity date at a specified price.

Bond Sinking Fund

A fund established by a debtor to repay or redeem bond debt before its maturity, ensuring financial security for bondholders.

Q17: Use the following information to determine the

Q42: A capital expenditures budget is prepared before

Q53: A company has two products: A and

Q67: Calculate the unit product cost using variable

Q130: Which of the following statements is true?<br>A)Under

Q136: Product costs consist of direct labor,direct materials,and

Q157: The margin of safety is the amount

Q158: The fixed overhead variance can be broken

Q184: Cost information from both absorption costing and

Q215: If actual price per unit of materials