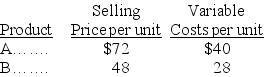

A firm sells two different products,A and B.For each unit of B sold,the firm sells two units of A.Total fixed costs $1,260,000.Additional selling prices and cost information for both products follow:

Required:

Required:

(a)Calculate the contribution margin per composite unit.

(b)Calculate the break-even point in units of each individual product.

(c)If pretax income before taxes of $294,000 is desired,how many units of A and B must be sold?

Definitions:

Cost of Goods Sold

Cost of Goods Sold (COGS) indicates the direct costs attributable to the production of the goods sold by a company, including material and labor expenses.

Sales

The total income a company generates from selling goods or services before any expenses are subtracted.

Cost of Goods Sold

An expense measure that reflects the cost of the materials and labor directly tied to the production of goods sold by a company.

Inventory Purchases

The total amount of goods a company buys for the purpose of reselling them during a particular period, often used to replenish stock levels.

Q38: The bottom line of a contribution margin

Q54: Barclay Bikes manufactures and sells three distinct

Q64: A cost that includes both fixed and

Q92: Using conversion cost per equivalent unit is

Q136: Solving problems to determine the relationship of

Q172: Reported income is identical under absorption costing

Q179: Why is overhead allocation under ABC usually

Q185: What costs are treated as product costs

Q188: A major disadvantage of using a plantwide

Q191: A product sells for $30 per unit