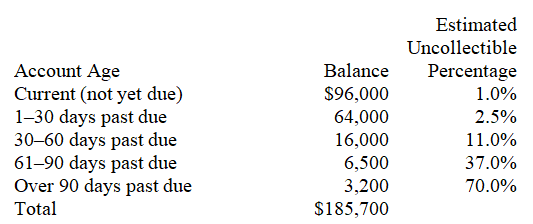

A company has the following unadjusted account balances at December 31,of the current year; Accounts Receivable of $185,700 and Allowance for Doubtful Accounts of $1,600 (credit balance).The company uses the aging of accounts receivable to estimate its bad debts.The following aging schedule reflects its accounts receivable at the current year-end:

1.Calculate the amount of the Allowance for Doubtful Accounts that should appear on the December 31,of the current year,balance sheet.

2.Prepare the adjusting journal entry to record bad debts expense for the current year.

Definitions:

Perceptually Prominent

Refers to objects or individuals that stand out in a perceptual field, making them more likely to attract attention and influence observations and behaviors.

Anthropology

The scientific study of humans, human behavior, and societies in the past and present, including cultural, social, and physical development.

Fundamental Attribution Error

The tendency to attribute others' behaviors to their character or personality, while overlooking situational factors.

Group Pressure

The influence exerted by a group on individual members to conform to the group's norms, attitudes, and behaviors.

Q11: The direct write-off method of accounting for

Q24: A company uses the periodic inventory system,and

Q42: Describe a bank reconciliation and discuss its

Q47: A _ is a report explaining any

Q73: The accounts receivable turnover indicates how often

Q83: The Community Store reported the following amounts

Q116: The process of using accounts receivable as

Q149: Depreciation is higher in earlier years and

Q149: Acceptable methods of assigning specific costs to

Q171: Zhang Co.uses a voucher system for documentation