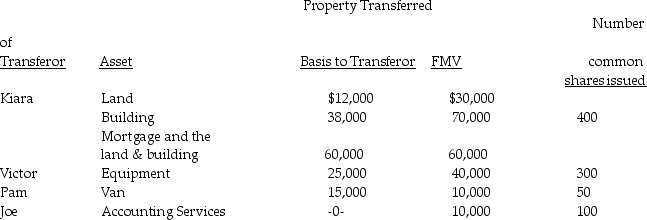

On May 1 of the current year, Kiara, Victor, Pam, and Joe form Newco Corporation with the following investments:

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

Kiara purchased the land and building several years ago for $12,000 and $50,000, respectively.Kiara has claimed straight-line depreciation on the building.Victor also received a Newco Corporation note for $10,000 due in three years.The note bears interest at a rate acceptable to the IRS.Victor purchased the equipment three years ago for $50,000.Pam also receives $5,000 cash.Pam purchased the van two years ago for $20,000.

a)Does the transaction satisfy the requirements of Sec.351?

b)What are the amounts and character of the reorganized gains or losses to Kiara, Victor, Pam, Joe, and Newco Corporation?

c)What is each shareholder's basis for his or her Newco stock? When does the holding period for the stock begin?

d)What is Newco Corporation's basis for its property and services? When does its holding period begin for each property?

Definitions:

Corporations

Legal entities established to conduct business, owning rights and liabilities separate from those of their members or shareholders.

The State

An organized political community living under a single system of government; may refer to the government or the territory it controls.

Perceptual Adaptation

The ability of the body to adjust to an environment by filtering out distractions.

Apparent Location

The perceived position of an object in space, which may differ from its actual position due to optical illusions or other factors.

Q2: A company has net income of $130,500.Its

Q3: Payment Corporation has accumulated E&P of $19,000

Q63: Parent Corporation owns 100% of the single

Q71: Identify which of the following statements is

Q83: Identify which of the following statements is

Q92: Phil and Nick form Philnick Corporation.Phil exchanges

Q96: The general business credit can be used

Q102: Lake Corporation distributes a building used in

Q153: All of the following statements regarding accounting

Q158: The fair value of the remaining 3,500