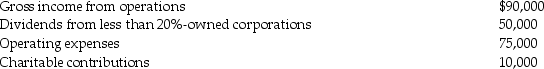

Dexter Corporation reports the following results for the current year:

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

In addition, Dexter has a $25,000 NOL carryover from the preceding tax year.What is Dexter's taxable income for the current year?

Definitions:

Self-concept

An individual's perception of themselves, encompassing beliefs, feelings, and thoughts about one’s identity and capabilities.

Life Review

The reflection on past experiences and one’s life, permitting greater self-understanding and the assignment of meaning to their lives.

Cognitive Appraisal

The process by which an individual evaluates and interprets an event or situation to determine its significance for their personal well-being.

Life Satisfaction

A subjective assessment of one's overall wellbeing and contentment with life, considering various aspects such as health, relationships, and achievements.

Q3: On May 1 of the current year,

Q4: Which of the following intercompany transactions creates

Q17: Identify which of the following statements is

Q17: Business assets of a sole proprietorship are

Q22: Which of the following transactions does not

Q32: In determining accumulated taxable income for the

Q42: Homewood Corporation adopts a plan of liquidation

Q59: When computing the accumulated earnings tax, which

Q97: Identify which of the following statements is

Q107: What is the purpose of a citator?