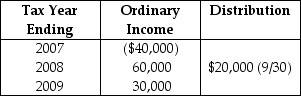

Robert Elk paid $100,000 for all of the single class of stock of Elkom Corporation, an electing S corporation, when incorporated in January, 2007.Elkom's operating results and dividend distribution are as follows:

What is Elk's basis for his Elkom stock on December 31 of 2007?

What is Elk's basis for his Elkom stock on December 31 of 2007?

Definitions:

Partnership Agreement

A formal contract between two or more parties who agree to manage and operate a business together, outlining the responsibilities, profit share, and rules for the partnership.

Personal Assets

Assets owned by an individual, including both tangible items like real estate and vehicles, and intangible items like stocks and bonds.

Capital

Financial assets or resources that individuals or organizations use to fund their operations and invest in their businesses.

Unlimited Personal Liability

A legal obligation where an individual's personal assets can be used to satisfy the debts and liabilities of the business.

Q6: Explain the three different limitation provisions that

Q13: Identify which of the following statements is

Q47: A trust distributes 30% of its income

Q51: Identify which of the following statements is

Q53: A calendar-year individual taxpayer files last year's

Q53: Roland, Shedrick, and Tyrone Corporations formed an

Q65: Shareholders in Boxer Corporation exchange all of

Q97: Which of the following communications between an

Q98: The governing instrument for the Lopez Trust

Q101: David sells his one-third partnership interest to