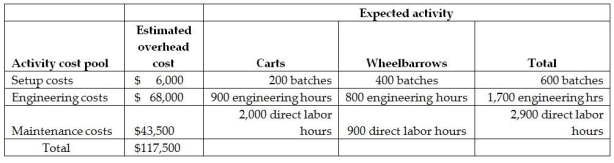

Vittoria Corporation manufactures two products-Carts and Wheelbarrows.The annual production and sales of Carts is 2,000 units,while 1,800 units of Wheelbarrows are produced and sold.The company has traditionally used direct labour hours to allocate its overhead to products.Carts require 1.0 direct labour hours per unit,while Wheelbarrows require 0.5 direct labour hours per unit.The total estimated overhead for the period is $117,500.The company is looking at the possibility of changing to an activity-based costing system for its products.If the company used an activity-based costing system,it would have the following three activity cost pools:

The overhead cost per Wheelbarrow using the traditional costing system would be closest to

Definitions:

Capital Input

The amount of capital goods used in the production process, influencing the output.

Competitive Firms

Companies that operate in a market where there are many buyers and sellers, and they have no control over the market price of their product.

Marginal Product

The additional output generated by adding one more unit of a specific input, holding all other inputs constant.

Profit-maximizing

A strategy or approach aimed at achieving the highest possible profit from business operations, often through cost management and optimal pricing.

Q7: The following chart shows three different costs:

Q18: Merchandising and service companies,as well as governmental

Q20: Plant-wide overhead rates typically do a better

Q73: Records for Josten's Custom Networks contained the

Q93: Your client's company wants to determine the

Q127: There are 36,000 units started.27,000 were completed

Q141: Using the high low method,what is the

Q206: What is the beginning work in process

Q221: In a process system,direct labour and manufacturing

Q252: What is the ending work in process