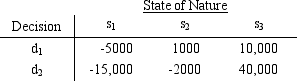

For the payoff table below,the decision maker will use P(s1)= .15,P(s2)= .5,and P(s3)= .35.

a.What alternative would be chosen according to expected value?

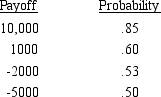

b.For a lottery having a payoff of 40,000 with probability p and -15,000 with probability (1-p),the decision maker expressed the following indifference probabilities.

Let U(40,000)= 10 and U(-15,000)= 0 and find the utility value for each payoff.

c.What alternative would be chosen according to expected utility?

Definitions:

Derivative Security

A financial security whose value is dependent upon or derived from one or more underlying assets.

Hedging

Reducing a firm’s exposure to price or rate fluctuations. Also immunization.

Economic Exposure

The risk that a company's cash flow, earnings, or future value will be affected by changes in exchange rates.

May Coffee Futures

Agreements that bind the purchaser to buy, and the seller to sell coffee, at an agreed price and date in the future.

Q1: Quarterly revenues (in $1,000,000's)for a national restaurant

Q14: Sensitivity analysis considers<br>A)how sensitive the decision maker

Q17: Kellam Images prints snack food bags on

Q18: What is the quark composition of the

Q21: Frederick Taylor is credited with forming the

Q28: Ionic bonding is due to<br>A) the sharing

Q31: An electron is in an infinite square

Q42: BP Cola must decide how much money

Q42: Which of the following is not true

Q44: If P(A <span class="ql-formula" data-value="\cup"><span class="katex"><span