Olson Corporation paid $62,000 to acquire 100% of Towing Corporation's outstanding voting common stock at book value on May 1,2013.The stockholders' equity of Towing on January 1,2013 consisted of $40,000 Capital Stock and $20,000 Retained Earnings.Towing's total dividends for 2013 were $6,000,paid equally on April 1 and October 1.Towing's net income was earned uniformly throughout 2013.In 2013,preacquisition sales were $10,000 and preacquisition expenses were cost of sales for $5,000.(There were no other preacquisition expenses in 2013 . )

During 2013,Olson made sales of $10,000 to Towing at a gross profit of $3,000.One-half of this merchandise was inventoried by Towing at year-end,and one-half of the 2011 intercompany sales were unpaid at year-end 2013.

Olson sold equipment with a ten-year remaining useful life to Towing at a $2,000 gain on December 31,2013.The straight-line depreciation method is used by both companies.The equipment has no salvage value.

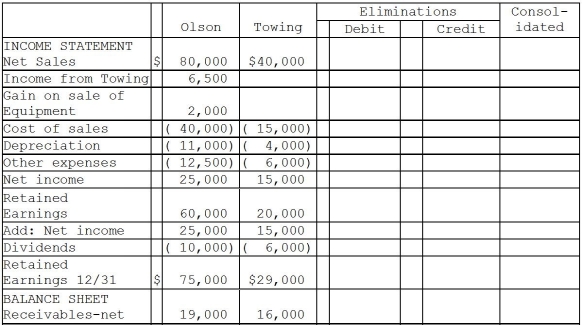

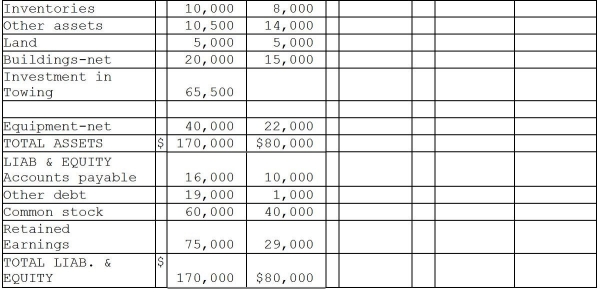

Financial statements of Olson and Towing Corporations for 2013 appear in the first two columns of the partially completed consolidation working papers.

Required:

Complete the consolidating working papers for Olson Corporation and Subsidiary for the year ending December 31,2013.

Definitions:

Quantity Demanded

The overall quantity of a product or service that buyers are ready and capable of buying at a specific price.

Price Change

Refers to the variation in the cost of a good or service over time.

Short Run

A period in economics during which at least one input, such as plant size, is fixed and cannot be changed.

Long Run

A period in economics where all factors of production and costs are variable, allowing for complete industry adjustment.

Q8: Will Wealth made three charitable donations in

Q14: Under the amended Uniform Probate Code,if the

Q17: Refer to Figure 20.2.An appreciation of the

Q20: Bonds Payable appeared in the December 31,2013

Q36: Silvia Peacock has been appointed to serve

Q36: Thoroughgood County has a municipal golf course

Q80: Assume that Bulgaria has a comparative advantage

Q125: An agreement negotiated by two countries that

Q247: The quantity supplied of dollars is likely

Q261: Any _ by Australian residents from overseas