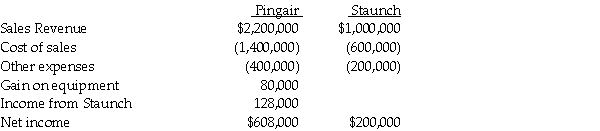

Separate income statements of Pingair Corporation and its 90%-owned subsidiary,Staunch Inc. ,for 2014 were as follows:

Additional information:

1.Pingair acquired its 90% interest in Staunch Inc.when the book values were equal to the fair values.

2.The gain on equipment relates to equipment with a book value of $120,000 and a 4-year remaining useful life that Pingair sold to Staunch for $200,000 on January 2,2014.The straight-line depreciation method is used.The equipment has no salvage value.

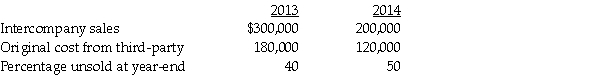

3.Pingair sold inventory to Staunch in 2013 and 2014 as shown in the table below.(The 2013 ending inventory is sold in 2014 . )

4.Staunch did not declare or pay dividends in 2013 and 2014.

Required:

1.Prepare adjusting/eliminating entries for the consolidation worksheet at December 31,2014.

2.Prepare a consolidated income statement for Pingair Corporation and Subsidiary for the year ended December 31,2014.

Definitions:

Achievement Motivation

The driving force behind striving to succeed or meet standards of excellence.

Statistical Analysis

The process of collecting, analyzing, interpreting, and presenting data to uncover underlying patterns and trends.

Face Validity

The extent to which a test appears to measure what it is intended to measure at face value, based on subjective judgment rather than objective criteria.

Social Anxiety

A trait dimension indicating the extent to which people experience anxiety during social encounters or when anticipating social encounters.

Q1: The 2014 consolidated income statement showed cost

Q1: The following information regarding the fiscal year

Q4: The following are transactions for the city

Q7: The best example of a tariff from

Q18: The following are transactions for the city

Q24: In reference to intercompany transactions between an

Q25: Oceana Corporation is being liquidated under Chapter

Q28: What statements are required for Government-wide financial

Q29: Coats for Kids is a private,not-for-profit organization

Q98: Which of the following is a source