Use the following information to answer the question(s) below.

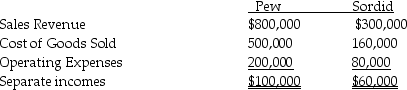

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-The 2014 consolidated income statement showed cost of goods sold of

Definitions:

NPV Estimates

Projections or calculations of the Net Present Value for different investments or projects to aid in decision-making.

Simulation Analysis

A technique used to predict the outcome of a project or investment by running multiple simulations with various sets of assumptions.

Capital Rationing

The process of restricting the amount of capital available for investment in new projects by a company due to budget constraints.

Managerial Options

Choices or decisions available to managers that allow them to steer the company in different strategic directions.

Q4: In contrast with single entity organizations,consolidated financial

Q5: Pigeon Corporation acquired an 80% interest in

Q10: When preparing the consolidation workpaper for a

Q14: Match the following fund balance descriptions for

Q22: Mary Contrary is the executor for the

Q27: Page Corporation acquired a 60% interest in

Q30: Austin contributes his computer equipment to the

Q32: Childrens Hospital is a private,not-for-profit hospital.The following

Q32: Noncontrolling interest share for Badrack is<br>A)$9,000.<br>B)$10,000.<br>C)$20,000.<br>D)$40,000.

Q99: Consider the market for dollars against the