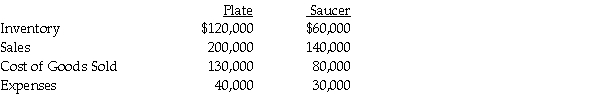

Presented below are several figures reported for Plate Corporation and Saucer Industries as of December 31,2014.Plate has owned 70% of Saucer for the past five years,and at the time of purchase,the book value of Saucer's assets and liabilities equaled the fair value.The cost of the 70% investment was equal to 70% of the book value of Saucer's net assets.At the time of purchase,the fair values and book values of Saucer's assets and liabilities were equal.

In 2013,Saucer sold inventory to Plate which had cost $40,000 for $60,000.25% of this inventory remained on hand at December 31,2013,but was sold in 2014.In 2014,Saucer sold inventory to Plate which had cost $30,000 for $45,000.40% of this inventory remained unsold at December 31,2014.

Required: Calculate following balances at December 31,2014.

a.Consolidated Sales

b.Consolidated Cost of goods sold

c.Consolidated Expenses

d.Noncontrolling interest share of Saucer's net income

e.Consolidated Inventory

Definitions:

Prevention Strategy

A plan or approach designed to avert or reduce the risk of diseases and other health problems before they occur.

Sodium

A chemical element (Na) that plays a crucial role in maintaining normal fluid balance and is necessary for proper muscle and nerve function.

Processed Foods

Foods that have been altered from their natural state, often for safety reasons or convenience, which can sometimes lead to reduced nutritional value.

Diet

The sum of food and drinks consumed by a person, affecting health and body function.

Q3: The year-end balance sheet and residual profit

Q7: Eve,Fig,Gus,and Hal are partners who share profits

Q11: A country that allows its exchange rate

Q24: On January 2,2014,PBL Enterprises purchased 90% of

Q27: The following are transactions for the city

Q30: What is the amount of consolidated Retained

Q30: Pallet Corporation owns 80% of Adelt Corporation

Q37: Which of the following will be debited

Q38: Olson Corporation paid $62,000 to acquire 100%

Q217: An economy that does not have interactions