Use the following information to answer the question(s) below.

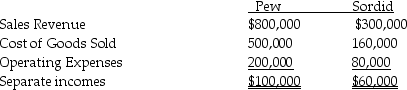

Pew Corporation acquired 80% ownership of Sordid Incorporated, at a time when Pew's investment cost was equal to 80% of Sordid's book value. At the time of acquisition, the book values and fair values of Sordid's assets and liabilities were equal. Pew uses the equity method. During 2014, Pew sold goods to Sordid for $160,000 making a gross profit percentage of 20%. Half of these goods remained unsold in Sordid's inventory at the end of the year. Income statement information for Pew and Sordid for 2014 were as follows:

-What is Pew's income from Sordid for 2014?

Definitions:

Q4: Which of the following statements is not

Q6: The main disadvantage of the sole proprietorship

Q6: Pfeifer Corporation acquired an 80% interest in

Q14: The first step in recording an acquisition

Q16: The following statements of financial accounting standards

Q30: 12-15.The following statement(s)is true:<br>A) the ability-to-pay theory

Q32: 13-31.In a loan closing the following two

Q33: The balance sheets of Palisade Company

Q42: Passcode Incorporated acquired 90% of Safe Systems

Q47: Under the entity theory,a consolidated balance sheet