Use the following information to answer the question(s) below.

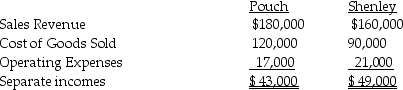

Pouch Corporation acquired an 80% interest in Shenley Corporation on January 1, 2014, when the book values of Shenley's assets and liabilities were equal to their fair values. The cost of the 80% interest was equal to 80% of the book value of Shenley's net assets. During 2014, Pouch sold merchandise that cost $70,000 to Shenley for $86,000. On December 31, 2014, three-fourths of the merchandise acquired from Pouch remained in Shenley's inventory. Separate incomes (investment income not included) of the two companies are as follows:

-What is Pouch's income from Shenley for 2014?

Definitions:

Cataract Removal

A surgical procedure to remove the clouded lens of the eye and, in most cases, replace it with an artificial one to restore vision.

Radical Mastectomy

A surgical procedure that involves the removal of one breast, along with the underlying chest muscles and lymph nodes to treat or prevent breast cancer.

Indwelling Urinary Catheter

A catheter placed inside the bladder to allow for continuous, passive urine drainage, often used in patients unable to void naturally.

Radical Prostatectomy

A surgical procedure to remove the entire prostate gland and some of the tissue around it to treat prostate cancer.

Q5: Pigeon Corporation acquired an 80% interest in

Q8: Snackle Inc.is a 90%-owned subsidiary of Pasha

Q10: If the sale referred to above was

Q15: Under the Uniform Probate Code,the personal representative

Q25: Phauna paid $120,000 for its 80% interest

Q28: The following are transactions for the city

Q32: Separate income statements of Plantation Corporation and

Q88: Since the 1970s,Australia's imports and exports have

Q94: The Australian economy would gain from the

Q95: If the Thai baht is pegged above