Use the following information to answer the question(s)below.

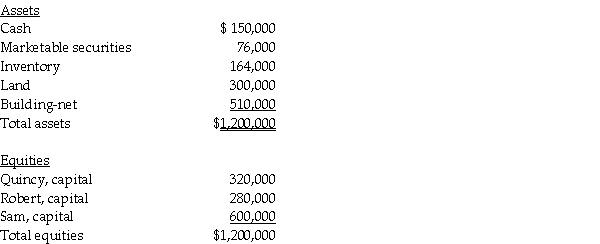

Quincy has decided to retire from the partnership of Quincy,Robert,and Sam.The partnership will pay Quincy $400,000.Total partnership capital should be revalued based on the excess payment to Quincy.(Assume the book values of the assets listed below equals fair values . )A summary balance sheet for the Quincy,Robert,and Sam partnership appears below.Quincy,Robert,and Sam share profits and losses in a ratio of 1:1:3,respectively.

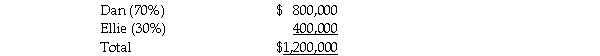

-Dan and Ellie share partnership profits and losses at 70% and 30%,respectively.The partners agree to admit Fran into the partnership for a 50% interest in capital and earnings.Capital accounts immediately before the admission of Fran are:

Required:

1.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $800,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Fran paid the money directly to Dan and to Ellie for 50% of each of their respective capital interests.The partnership records goodwill.

2.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $1,000,000 for the ownership interest.Fran paid the money to the partnership for a 50% interest in capital and earnings.Assume the valuation is based on the capital of the current partnership,which is fairly valued.The partnership records goodwill.

3.Prepare the journal entry(s)for the admission of Fran to the partnership assuming Fran invested $1,400,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Fran paid the money to the partnership for a 50% interest in capital and earnings.The partnership records goodwill.

Definitions:

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a data set, assigning more weight to some numbers and less to others.

Earnings Per Share

A financial metric that measures the amount of a company's profit allocated to each outstanding share of its common stock.

Outstanding Common Stock

Shares of a corporation's stock that have been issued and are in the hands of investors, but not repurchased by the company.

Restricted Retained Earnings

Earnings that are not freely available for dividend distribution or other purposes due to legal or contractual restrictions.

Q1: The position of an object as a

Q3: How much cash must Oran invest to

Q6: If the partnership experiences a net loss

Q7: A forward contract used as a cash

Q13: What is 56 + (32.00)/(1.2465 + 3.45)written

Q16: Ohio Corporation is being liquidated under Chapter

Q19: Johnsen Corporation paid $225,000 for a 70%

Q20: At any point in time,a government will

Q36: Petra Corporation paid $500,000 for 80% of

Q43: If an operatic aria lasts for 5.75