Use the following information to answer the question(s) below.

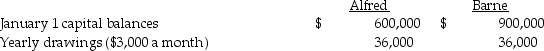

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-If the partnership experiences a net loss of $60,000 for the year,what will be the final net amount of profit or (loss) closed to each partner's capital account?

Definitions:

Overapplied Balance

A situation in cost accounting where the amount of overhead applied to products or services exceeds the actual overhead costs incurred.

Manufacturing Overhead Account

An account used to record all indirect costs associated with the production process, including utilities, rent, and salaries for managers.

Work in Process

Inventory items that are in the production process but are not yet completed goods.

Predetermined Overhead Rate

A rate calculated before a period begins by dividing estimated manufacturing overhead costs by an estimated allocation base, used to allocate overhead costs to products.

Q1: The 2014 consolidated income statement showed cost

Q3: How much cash must Oran invest to

Q3: Trustin Corporation is in a Chapter 7

Q12: The City of Electri entered the following

Q18: If the partnership agreement provides a formula

Q22: Several years ago,Peacock International purchased 80% of

Q24: The modified accrual basis of accounting is

Q31: What is the sum of 1.53 +

Q32: 0)00325 × 10<sup>-8</sup> cm can also be

Q33: Stilt Corporation purchased a 40% interest in