Use the following information to answer the question(s)below.

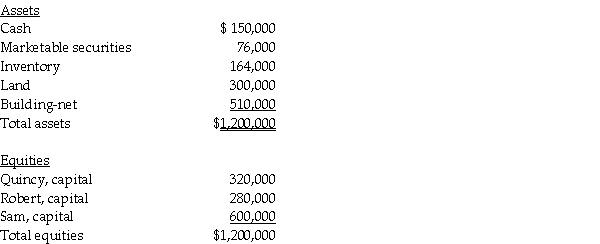

Quincy has decided to retire from the partnership of Quincy,Robert,and Sam.The partnership will pay Quincy $400,000.Total partnership capital should be revalued based on the excess payment to Quincy.(Assume the book values of the assets listed below equals fair values . )A summary balance sheet for the Quincy,Robert,and Sam partnership appears below.Quincy,Robert,and Sam share profits and losses in a ratio of 1:1:3,respectively.

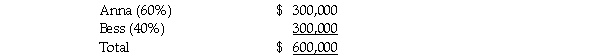

-Anna and Bess share partnership profits and losses at 60% and 40%,respectively.The partners agree to admit Cal into the partnership for a 50% interest in capital and earnings.Capital accounts immediately before the admission of Cal are:

Required:

1.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $400,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Cal paid the money directly to Anna and to Bess for 50% of each of their respective capital interests.The partnership records goodwill.

2.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $500,000 for the ownership interest.Cal paid the money to the partnership for a 50% interest in capital and earnings.Assume the valuation is based on the capital of the current partnership,which is fairly valued.The partnership records goodwill.

3.Prepare the journal entry(s)for the admission of Cal to the partnership assuming Cal invested $700,000 for the ownership interest,and that this is a fair price for that share of the partnership to be acquired.Cal paid the money to the partnership for a 50% interest in capital and earnings.The partnership records goodwill.

Definitions:

Q7: If,in a parallel universe,π has the value

Q9: Assume there are routine inventory sales between

Q12: The partnership of May,Novem,and Octo was dissolved.By

Q13: Consider what happens when you jump up

Q26: Samantha's Sporting Goods had net assets consisting

Q34: When preparing consolidated financial statements,which of the

Q35: Which one of the following items,originally recorded

Q38: What is the total amount for the

Q39: A 1000-kg car is driving toward the

Q40: The acceleration of an object as a