Use the following information to answer the question(s) below.

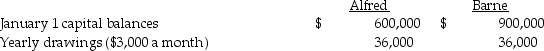

Alfred and Barne share profits and losses in a ratio of 2:3, respectively, after salary allowances, interest allowances and bonus allocations. Alfred and Barne receive salary allowances of $30,000 and $60,000, respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners' drawings are not used in determining the average capital balances. Total net income for 2014 is $180,000. If net income after deducting the interest and salary allocations is more than $60,000, Barne receives a bonus of 5% of the original amount of net income.

-What is the total amount for the allocation of interest,salary,and bonus,and how much over-allocation is present?

Definitions:

Q1: The position of an object as a

Q6: Separate company and consolidated income statements for

Q6: Bounty County had the following transactions in

Q9: The motions of a car and a

Q11: Approximately how many times does an average

Q27: Sally Corporation's stockholders' equity on December 31,2014

Q27: On January 2,2014,Paogo Company sold a truck

Q27: Which of the following are entitled to

Q28: Controlling interest share in consolidated net income

Q52: On its own,a certain tow-truck has a