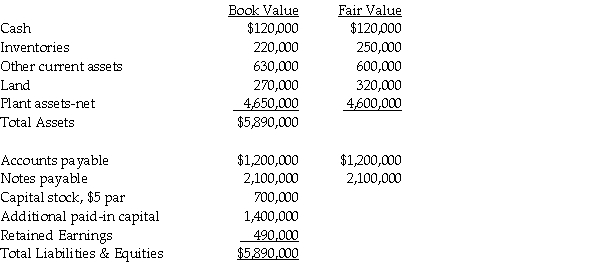

Parrot Incorporated purchased the assets and liabilities of Sparrow Company at the close of business on December 31,2013.Parrot borrowed $2,000,000 to complete this transaction,in addition to the $640,000 cash that they paid directly.The fair value and book value of Sparrow's recorded assets and liabilities as of the date of acquisition are listed below.In addition,Sparrow had a patent that had a fair value of $50,000.

Required:

1.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow survives as a separate legal entity.

2.Prepare Parrot's general journal entry for the acquisition of Sparrow,assuming that Sparrow will dissolve as a separate legal entity.

Definitions:

GDP Deflator

The GDP Deflator is a measure of the price level of all domestically produced goods and services in a country, used to adjust nominal GDP to real GDP.

Nominal Interest Rate

The percentage increase in money you pay the lender for the use of the money you borrowed, not adjusted for inflation.

Real Interest Rate

The interest rate adjusted for inflation, reflecting the real cost of borrowing and the real yield on savings.

Purchasing Power

The value of a currency expressed in terms of the quantity of goods or services that one unit of money can buy, often influenced by inflation.

Q1: Required:<br>1.Prepare a schedule to allocate income to

Q3: In a perfectly ELASTIC collision between two

Q4: The cash available for distribution to the

Q8: What should be the noncontrolling interest share,common

Q24: An airplane that is flying level needs

Q25: On November 1,2013,Athom Corporation purchased 5,000 television

Q30: Crabby Industries,a U.S.corporation,purchased inventory from a company

Q31: Two forces act on a 55-kg object.One

Q36: An 8.0-g bullet is shot into a

Q45: Future space stations will create an artificial