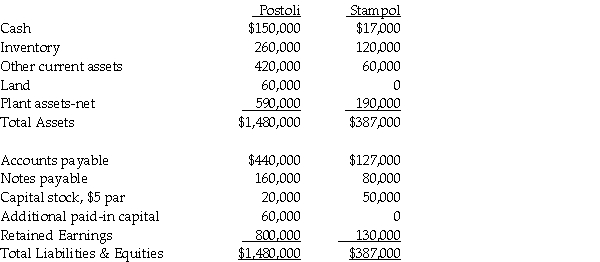

On June 30,2013,Stampol Company ceased operations and all of their assets and liabilities were purchased by Postoli Incorporated.Postoli paid $40,000 in cash to the owner of Stampol,and signed a five-year note payable to the owners of Stampol in the amount of $200,000.Their closing balance sheets as of June 30,2013 are shown below.In the purchase agreement,both parties noted that Inventory was undervalued on the books by $10,000,and Pistoli would also take possession of a customer list with a fair value of $18,000.Pistoli paid all legal costs of the acquisition,which amounted to $7,000.

Required:

1.Prepare the journal entry Postoli would record at the date of acquisition.

2.Prepare the journal entry Stampol would record at the date of acquisition.

Definitions:

Q3: A block is given a very brief

Q3: For the year ending December 31,2014,the amount

Q11: Paster Corporation was seeking to expand its

Q12: 15)Bumpers on cars are not of much

Q14: A Ferris wheel has diameter of 10

Q17: A 1.2-kg spring-activated toy bomb slides on

Q21: Pretax operating incomes of Pang Corporation and

Q27: The unadjusted trial balance for the general

Q39: Partridge Corporation purchased an 80% interest in

Q123: A box of mass m is pulled