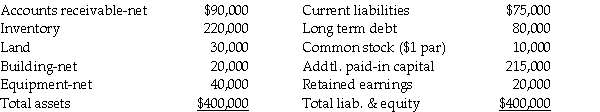

Bigga Corporation purchased the net assets of Petit,Inc.on January 2,2013 for $380,000 cash and also paid $15,000 in direct acquisition costs.Petit,Inc.was dissolved on the date of the acquisition.Petit's balance sheet on January 2,2013 was as follows:

Fair values agree with book values except for inventory,land,and equipment,which have fair values of $260,000,$35,000 and $35,000,respectively.Petit has patent rights with a fair value of $20,000.

Required:

Prepare Bigga's general journal entry for the cash purchase of Petit's net assets.

Definitions:

Q4: Anna and Bess share partnership profits and

Q6: Under parent company theory,noncontrolling interest is valued

Q6: A 2.0 kg mass is moving along

Q10: In September of 2014,Gunny Corporation anticipates that

Q13: Suppose that a car traveling to the

Q18: If the partnership agreement provides a formula

Q19: On July 1,2014,Joe,Kline,and Lama began a partnership

Q20: Journalize the following utility transactions in the

Q22: Assuming a present value factor of 1

Q32: A boy throws a rock with an