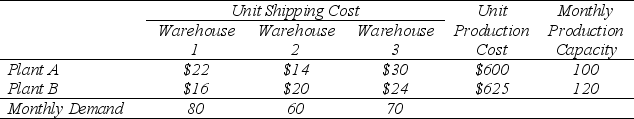

Heart Start produces automated external defibrillators (AEDs)in each of two different plants (A and B).The unit production costs and monthly production capacity of the two plants are indicated in the table below.The AEDs are sold through three wholesalers.The shipping cost from each plant to the warehouse of each wholesaler along with the monthly demand from each wholesaler are also indicated in the table.How many AEDs should be produced in each plant,and how should they be distributed to each of the three wholesaler warehouses so as to minimize the combined cost of production and shipping?  (a)Formulate this problem as a transportation problem by constructing the appropriate parameter table.(b)Formulate and solve a linear programming model in a spreadsheet for this problem.

(a)Formulate this problem as a transportation problem by constructing the appropriate parameter table.(b)Formulate and solve a linear programming model in a spreadsheet for this problem.

Definitions:

Salvaged

Refers to assets that have been recovered, reused, or sold after being discarded or considered waste.

Tax Shield Approach

A financial strategy that utilizes deductible expenses, like interest, to reduce a company's taxable income, thereby lowering its tax liability.

Operating Cash Flow

The cash generated from a company's normal business operations, indicating its ability to generate positive cash flow.

CCA Class

A classification system used in Canadian tax law for capital cost allowance, determining the depreciation rate for tax purposes of tangible capital assets.

Q7: What are the three steps to implementing

Q14: In which of the following cases is

Q41: The so-called General Arrangements to Borrow provide

Q46: Concerning the generation of financial statements from

Q56: Refer to Figure 17.1.If the exchange rate

Q58: M:N relationships must be implemented<br>A)As separate tables<br>B)With

Q61: Financial institution number is most likely to

Q65: What is the basic model used to

Q92: Under the price-adjustment mechanism,a government's efforts to

Q94: Identify the main reasons why companies change