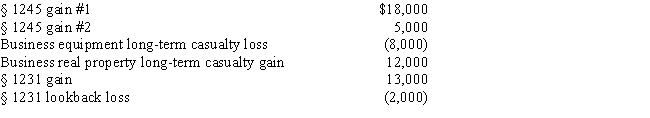

Betty, a single taxpayer with no dependents, has the gains and losses shown below. Before considering these transactions, Betty has $45,000 of other taxable income. What is the treatment of the gains and losses and what is Betty's taxable income?

Definitions:

Thomas And Chess

Psychologists known for their research in child development and the concept of temperament.

Anxious Temperament

A predisposition to respond with fear, tension, and anxiety to situations that are not inherently threatening.

Cross-Sectional Study

A research method that analyzes data from a population, or a representative subset, at a specific point in time.

Teaching Method

A systematic approach or strategy used by educators to facilitate learning in students, which can vary widely depending on the subject matter, student needs, and educational goals.

Q18: Terry, Inc., makes gasoline storage tanks. All

Q31: Red Corporation and Green Corporation are equal

Q40: Changes in the liabilities (trade accounts payable,

Q47: Rex and Dena are married and have

Q75: Which of the following events causes the

Q102: A realized loss whose recognition is postponed

Q111: Byron, who lived in New Hampshire, acquired

Q117: The exchange of unimproved real property located

Q148: If the fair market value of the

Q151: Two unrelated, calendar year C corporations have