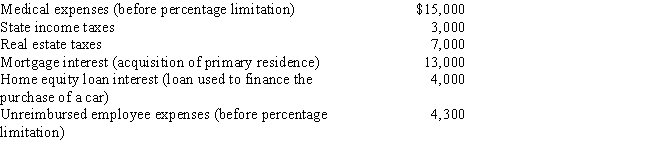

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year. His potential itemized deductions were as follows.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

Definitions:

Tariff

A tax imposed by a government on imported goods or services to protect domestic industries or generate revenue.

Infant Industry

A new or emerging industry that may be protected by the government from international competition to allow it to grow.

Technological Efficiency

A measure of the effectiveness with which a technology converts inputs into outputs, often seen as achieving the maximum productivity with the least waste.

Silicon Chip

A small piece of silicon that contains integrated circuits used in electronic devices for processing or storage.

Q3: Shirley sold her personal residence to Mike

Q15: Sand Corporation, a calendar year C corporation,

Q38: Hubert purchases Fran's jewelry store for $950,000.

Q52: Leonore exchanges 5,000 shares of Pelican, Inc.,

Q66: On October 1, Paula exchanged an apartment

Q77: During the year, Purple Corporation (a U.S.

Q88: Georgia had AGI of $100,000 in 2017.

Q94: Harry earned investment income of $18,500, incurred

Q127: Mixed use (both business and pleasure) domestic

Q135: Jacob owns land with an adjusted basis