Essay

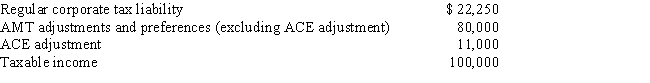

Crimson, Inc., provides you with the following information.

Calculate Crimson's AMT for 2017.

Calculate Crimson's AMT for 2017.

Definitions:

Related Questions

Q5: Aaron is a self-employed practical nurse who

Q21: Due to a merger, Allison transfers from

Q24: Jared, a fiscal year taxpayer with a

Q33: White Company acquires a new machine (seven-year

Q34: During the year, Walt travels from Seattle

Q53: The maximum amount of the § 121

Q84: Alexis (a CPA) sold her public accounting

Q102: Georgia contributed $2,000 to a qualifying Health

Q105: Realizing that providing for a comfortable retirement

Q124: Dave is the regional manager for a