Essay

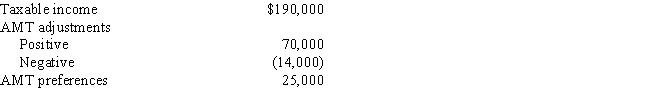

Use the following data to calculate Jolene's AMTI in 2017. Jolene itemizes deductions.

Definitions:

Related Questions

Q2: The luxury auto cost recovery limits applies

Q12: Rick, a computer consultant, owns a separate

Q20: Which, if any, of the following factors

Q36: Ramon sells land with an adjusted basis

Q43: When a property transaction occurs, what four

Q84: Darin, who is age 30, records itemized

Q87: The "luxury auto" cost recovery limits change

Q119: Liz, age 55, sells her principal residence

Q158: At age 65, Camilla retires from her

Q171: A taxpayer who lives and works in