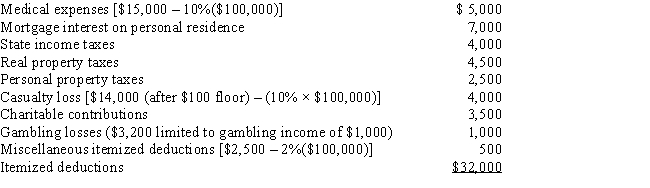

Darin, who is age 30, records itemized deductions in calculating 2017 taxable income as follows.

a.Calculate Darin's itemized deductions for AMT purposes using the direct method.

b.Calculate Darin's itemized deductions for AMT purposes using the indirect method.

Definitions:

Bonuses

Monetary rewards offered by companies for exceptional performance as incentives to further increase productivity.

Theory X Manager

A management style based on the assumption that employees are inherently lazy and will avoid work if they can, necessitating a controlling and directive leadership style.

Q16: For purposes of computing the deduction for

Q34: Maria made significant charitable contributions of capital

Q38: Ethan, a bachelor with no immediate family,

Q79: The work opportunity tax credit is available

Q83: Charles, who is single and age 61,

Q93: Mindy paid an appraiser to determine how

Q101: Distinguish between a direct involuntary conversion and

Q103: The factor for determining the cost recovery

Q104: Which of the following can produce an

Q117: In calculating her 2017 taxable income, Rhonda,