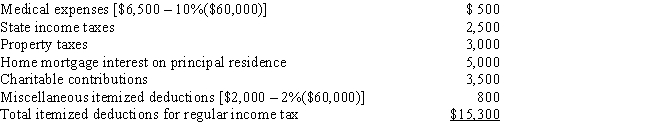

In calculating her 2017 taxable income, Rhonda, who is age 45, claims the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Definitions:

Traditional Marketing Channels

Refers to the paths or routes through which goods and services flow from the producer to the consumer, typically including print media, television, radio, and face-to-face sales.

Digital Marketing Channels

Online platforms and tools used for promoting and selling products or services, such as social media, email, and websites.

Orthopedic Surgery

A branch of surgery concerned with conditions involving the musculoskeletal system.

Multichannel Marketing

A marketing strategy that involves interacting with customers via multiple channels, both direct and indirect, to sell products or services.

Q6: What itemized deductions are allowed for both

Q37: Sadie mailed a check for $2,200 to

Q40: Cardinal Corporation hires two persons certified to

Q76: Louis owns a condominium in New Orleans

Q77: Karen, a calendar year taxpayer, made the

Q79: During the year, Victor spent $300 on

Q85: Dan contributed stock worth $16,000 to his

Q89: James has a job that compels him

Q96: The fair market value of property received

Q107: Section 1033 (nonrecognition of gain from an