Jesse placed equipment that cost $48,000 in service in 2015 (neither § 179 expensing nor bonus depreciation was elected) . On July 1, 2017, Jesse sold the equipment for $22,000.

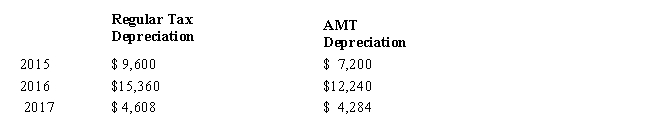

Regular tax and AMT depreciation amounts for the equipment are computed as follows.

What AMT adjustments will be required for the equipment for 2017?

Definitions:

Marginal Utility

The extra pleasure or benefit gained by a consumer from consuming an additional unit of a product or service.

Marginal Utility

The additional satisfaction or utility gained from consuming an extra unit of a good or service.

Water-Diamond Paradox

A concept in economics that questions why diamonds are more expensive than water despite water being essential for survival and diamonds not.

Marginal Utility

The additional satisfaction or benefit received from consuming one more unit of a good or service.

Q2: In 2017, Kipp invested $65,000 for a

Q4: Zeke made the following donations to qualified

Q36: Judy owns a 20% interest in a

Q64: Helen purchases a $10,000 corporate bond at

Q66: Frederick sells equipment whose adjusted basis for

Q76: Roger owns and actively participates in the

Q92: Identify two tax planning techniques that can

Q110: Treatment of a disposition of a passive

Q115: A, B and C are each single,

Q155: In the current year, Bo accepted employment