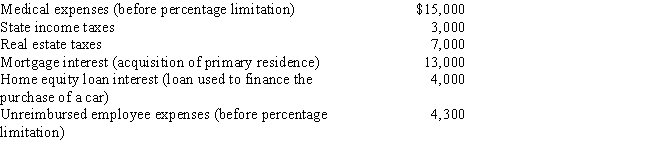

Mitch, who is single and age 46 and has no dependents, had AGI of $100,000 this year. His potential itemized deductions were as follows.

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

What is the amount of Mitch's AMT adjustment for itemized deductions for 2017?

Definitions:

Alcoholism

A chronic disease characterized by uncontrolled drinking and a preoccupation with alcohol.

Indirectly Affected

To be impacted by an action, event, or situation in a secondary or less immediate way.

Communication

The act of conveying information or expressing ideas and feelings through verbal, nonverbal, written, or visual means.

Listening

The active process of receiving, interpreting, and responding to verbal and non-verbal messages.

Q39: Individuals with modified AGI of $100,000 can

Q41: The IRS will issue advanced rulings as

Q50: Milton purchases land and a factory building

Q51: Matt, a calendar year taxpayer, pays $11,000

Q84: The surrender of depreciated boot (fair market

Q85: Nathan owns Activity A, which produces income,

Q99: Lynn determines when the services are to

Q108: In 2017, Linda incurs circulation expenses of

Q110: Both traditional and Roth IRAs possess the

Q167: For the current football season, Tern Corporation