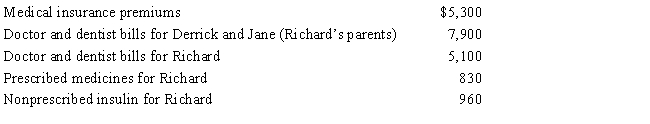

Richard, age 50, is employed as an actuary. For calendar year 2017, he had AGI of $130,000 and paid the following medical expenses: Derrick and Jane would qualify as Richard's dependents except that they file a joint return. Richard's medical insurance policy does not cover them. Richard filed a claim for $4,800 of his own expenses with his insurance company in November 2017 and received the reimbursement in January 2018. What is Richard's maximum allowable medical expense deduction for 2017?

Definitions:

Interest

The cost of borrowing money or the reward for saving, typically represented as a percentage of the principal amount over a specific period.

Borrowed

Money that one has taken on loan from another party, under the condition that it will be repaid, usually with interest, at a later date.

Interest

The charge for borrowing money or the return on invested capital, usually expressed as an annual percentage rate.

Interest Rate

The fraction of a borrowed sum that incurs interest charges for the borrower, often expressed in terms of a yearly percentage.

Q3: In January 2017, Tammy acquired an office

Q7: Expenses incurred for the production or collection

Q8: On February 1, 2017, Omar acquires used

Q20: How can an AMT adjustment be avoided

Q50: A baseball team that pays a star

Q56: If an activity involves horses, a profit

Q57: A taxpayer is considered to be a

Q81: Fees for automobile inspections, automobile titles and

Q105: Emily, who lives in Indiana, volunteered to

Q113: A moving expense deduction is allowed even