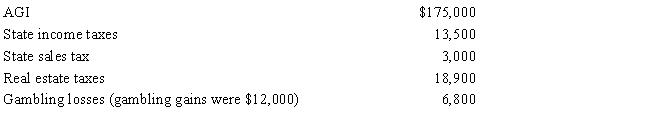

Paul, a calendar year married taxpayer, files a joint return for 2017. Information for 2017 includes the following: Paul's allowable itemized deductions for 2017 are:

Definitions:

Conceptual Skills

The ability to understand complex ideas, identify patterns, and solve problems by looking at the bigger picture.

Technical Skills

Specific abilities or competencies required to perform particular tasks or operate specific equipment or software.

First-level Manager

A manager who is directly responsible for overseeing the work of entry-level employees, typically the first layer of management in an organization.

Organizing Function

The organizing function involves arranging resources and tasks to achieve the objectives of an organization efficiently.

Q15: Contributions to public charities in excess of

Q20: A corporation which makes a loan to

Q23: Research and experimental expenditures do not include

Q38: All listed property is subject to the

Q39: Sergio was required by the city to

Q39: Individuals with modified AGI of $100,000 can

Q55: A loss from a worthless security is

Q73: Al, who is single, has a gain

Q102: Any unused general business credit must be

Q115: An NOL carryforward is used in determining